Imagine this scenario.

It’s finally Friday. You’ve long yearned for this day to arrive because it’s been incredibly tiring and demoralizing at work. And you’ve decided you want to hang out with your buddies. You all meet up at the nearest pub to enjoy a few beers and to chow down on a cheeseburger. Then next Friday arrives, rinse and repeat. Then Fridays become Thursday and Fridays. Rinse and repeat.

Now imagine what your wallet or purse looks like after a month of this. After 6 months. Then calculate after a year! Frightening, isn’t it?

Why do I budget?

Like many, I didn’t grow up with an understanding of budgeting and personal finances. I didn’t quite understand the concept of savings and how this eventually could compound, leading to early retirement. And like many others, I figure my job would always be there and be my primary source of income. C’mon, let me eat that burger!

However, as I’ve grown older over the years, I realize now how so very important budgeting and savings is. I’ve worked in corporate finance for the past 8 years supporting both multi-billion conglomerates to billion dollar ecommerce platform companies. In each of these I was in charge of managing millions and billions of dollars worth of budgets including operating expenses, capital expenditures as well as partnering with executives to drive the growth of the companies. It’s this that lead me to understand and build out my own budgets.

So how did I budget for myself? Because I was an excel nerd (love it!), I decided I wanted to build a financial model for myself that would show me my budget in a way I could understand. I also leveraged the way I learned it at my job to build out my template. The data to support my model would be from Mint – I personally love this tool and encourage others to use it.

My Budget Tool

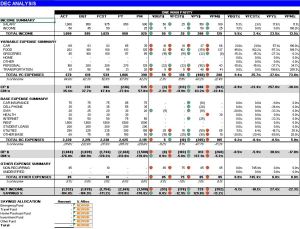

Here are a few of the capabilities I’ve built into my tool below. I look at my budget like I would with managing any business – through a P&L (profit and loss). Here is how I break it down within my household budget (numbers are for demonstration purposes only):

General P&L by Month

Budget Snapshot (what I will target for the year with a monthly re-forecast)

Budget Snapshot (what I will target for the year with a monthly re-forecast)

Annual Budget Analysis (review by years)

Long-Term Financial Budget Analysis (review where my budget could be 10 years down)

There are many more applications and views within my budget tool, but these are a few that allow me to keep both my finances and goals in check. I don’t want to work forever!

Thoughts over the years

I hadn’t realized till writing this post, but I’ve been managing this budget tool of mine since 2009! I have nearly 8 years of solid financial data; with this, I can and try to make better decisions.

For example, based on my P&L results I knew my internet two-year rate was coming to an end and would spike up to nearly $75! A’int nobody got time for that! So I called the internet company, informed them a competitor is offering a lower price, and just like that, they provided me with a new, lower rate! Simple, easy, and all it took was 5 minutes on the phone!

I hope this post helps you think about your own budget and, with a little bit of effort, you, too, can change your habits and start saving better. When you have the data at your disposal, you no longer guess or wonder – because you know now.

As always, feel free to leave a comment, thought or suggestion. Enjoy the weekend, everyone!